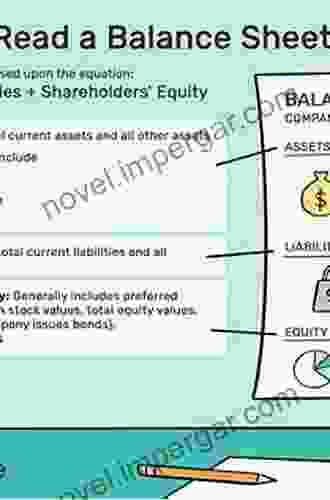

How to Read a Balance Sheet: A Simplified Guide to Understanding Financial Statements

Balance sheets are essential financial statements that provide a snapshot of a company's financial health at a specific point in time. They play a crucial role in decision-making for investors, creditors, and business owners alike. Understanding how to read and interpret balance sheets is paramount for making informed financial decisions and assessing the financial stability of companies. 4.3 out of 5 Step 1: Assets Assets represent the resources owned by the company. They are typically divided into current assets (cash, inventory, accounts receivable) and non-current assets (property, equipment, investments). Current assets are expected to be converted into cash within a year, while non-current assets are held for longer periods. Step 2: Liabilities Liabilities are the company's obligations to others. They include current liabilities (short-term debt, accounts payable, accrued expenses) and non-current liabilities (long-term debt, bonds). Current liabilities are due within a year, while non-current liabilities mature over a longer period. Step 3: Equity Equity represents the owners' stake in the company. It is calculated as the difference between assets and liabilities. A positive equity value indicates that the company has more assets than liabilities, while a negative value indicates that the company has more liabilities than assets. Step 4: Analyzing the Balance Sheet Once you have identified the key components of the balance sheet, you can begin to analyze the company's financial health. This involves comparing different metrics, such as: To illustrate the practical application of balance sheet analysis, we will walk through real-life examples and case studies. Mastering the art of reading balance sheets is a valuable skill for anyone looking to make informed financial decisions. This guide provides a comprehensive overview of the key concepts and steps involved in understanding these essential financial statements. By applying the principles outlined in this article, you can empower yourself with the knowledge and confidence to navigate the complex world of corporate finance. For a more in-depth understanding of balance sheets and financial statement analysis, I highly recommend the book "How to Read a Balance Sheet" by John Tracy. This acclaimed publication provides a comprehensive and practical guide to deciphering these complex financial documents. Click here to Free Download your copy today and unlock the secrets of corporate finance. : The Importance of Understanding Balance Sheets

Language : English File size : 857 KB Text-to-Speech : Enabled Screen Reader : Supported Enhanced typesetting : Enabled Word Wise : Enabled Print length : 209 pages Step-by-Step Guide to Reading a Balance Sheet

Real-Life Examples and Case Studies

: Empower Yourself with Financial Literacy

About the Book: "How to Read a Balance Sheet"

4.3 out of 5

| Language | : | English |

| File size | : | 857 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 209 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Ross Barnett

Ross Barnett Virag Shah

Virag Shah Stephen Grey

Stephen Grey Robert Bireley

Robert Bireley Robert Carroll

Robert Carroll Rob Burbea

Rob Burbea Sharnel Williams

Sharnel Williams Saurabh Sawhney

Saurabh Sawhney Rob Cary

Rob Cary Robert Shearman

Robert Shearman Sarah Kozloff

Sarah Kozloff Rob Desalle

Rob Desalle Will Hanley

Will Hanley Robert Harry Lowie

Robert Harry Lowie Steven T Usdin

Steven T Usdin Robert Sherrick Brumbaugh

Robert Sherrick Brumbaugh Sam Gennawey

Sam Gennawey Ruth Klein

Ruth Klein Sorpong Peou

Sorpong Peou Roland Philipps

Roland Philipps

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brayden ReedDiscover the Enchanting History of South Santa Clara County with Sam Shueh's...

Brayden ReedDiscover the Enchanting History of South Santa Clara County with Sam Shueh's... Carter HayesFollow ·17.8k

Carter HayesFollow ·17.8k Jaylen MitchellFollow ·17.5k

Jaylen MitchellFollow ·17.5k Mario Vargas LlosaFollow ·13.5k

Mario Vargas LlosaFollow ·13.5k Ernesto SabatoFollow ·11.9k

Ernesto SabatoFollow ·11.9k Brett SimmonsFollow ·18k

Brett SimmonsFollow ·18k Isaias BlairFollow ·3.3k

Isaias BlairFollow ·3.3k Isaiah PriceFollow ·18.8k

Isaiah PriceFollow ·18.8k Cameron ReedFollow ·5.6k

Cameron ReedFollow ·5.6k

Colt Simmons

Colt SimmonsLarge Collieries Iron Mines Stone Iron And Tinplate...

Step back in time and witness...

Zachary Cox

Zachary CoxUnlocking the Secrets of Woody Plants: An In-Depth...

: Embark on a captivating journey into the...

Yasunari Kawabata

Yasunari KawabataIntroducing 'Librarian Guide: 3rd Edition' – The Ultimate...

In the dynamic and ever-evolving...

Jerome Blair

Jerome BlairEvading Honesty: A Masterful Exploration of Deceit and...

Prepare to be captivated...

Timothy Ward

Timothy WardLove Is Real: A Novel of Love, Loss, and the Enduring...

Prepare to embark on a...

4.3 out of 5

| Language | : | English |

| File size | : | 857 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 209 pages |