Unveiling the Secrets of Southern Company's Stock Performance: A Comprehensive Guide to Price Forecasting Models

In the ever-evolving landscape of financial markets, accurately forecasting stock prices is a daunting yet lucrative endeavor. This article delves into the intricacies of price forecasting models specifically designed for Southern Company's (SO) stock, a prominent utility holding company listed on the S&P 500 Index. By examining various statistical and machine learning techniques, we aim to provide investors with a comprehensive understanding of the factors influencing SO's stock performance and equip them with valuable tools to make informed investment decisions.

Southern Company: An Overview

Southern Company, headquartered in Atlanta, Georgia, is one of the largest utility companies in the United States. Its operations span across multiple states, providing electricity to millions of customers. The company's stock, traded under the symbol SO, has consistently ranked among the top performers in the utility sector.

5 out of 5

| Language | : | English |

| File size | : | 1500 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |

Factors Influencing SO's Stock Price

- Demand for Electricity: As a utility provider, SO's revenue is directly tied to the demand for electricity, which is influenced by factors such as economic growth, population changes, and weather patterns.

- Regulatory Environment: Utilities are subject to extensive regulation, affecting their pricing, service quality, and environmental compliance. Changes in regulatory policies can significantly impact SO's financial performance.

- Operating Costs: Fuel costs, labor expenses, and capital investments are key factors influencing SO's operating costs. Fluctuations in these costs can impact the company's profitability and stock price.

- Economic Conditions: SO's stock performance is affected by macroeconomic factors such as interest rates, inflation, and overall economic health. Economic downturns can lead to reduced demand for electricity, while periods of economic growth typically boost demand.

- Dividend Policy: Southern Company has a history of paying regular dividends to its shareholders. The dividend payout ratio, along with the company's earnings performance, influences the stock's attractiveness to income-oriented investors.

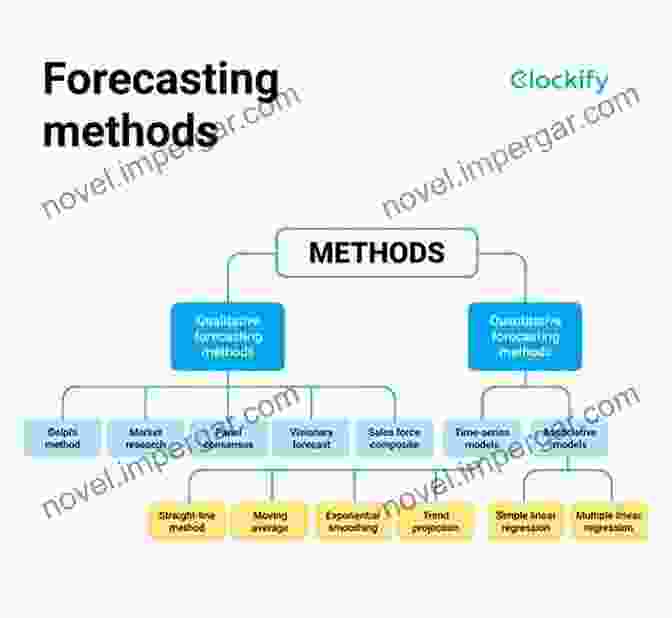

Price Forecasting Models for SO Stock

Numerous statistical and machine learning models have been developed to forecast the stock price of Southern Company. Here are some of the most commonly employed techniques:

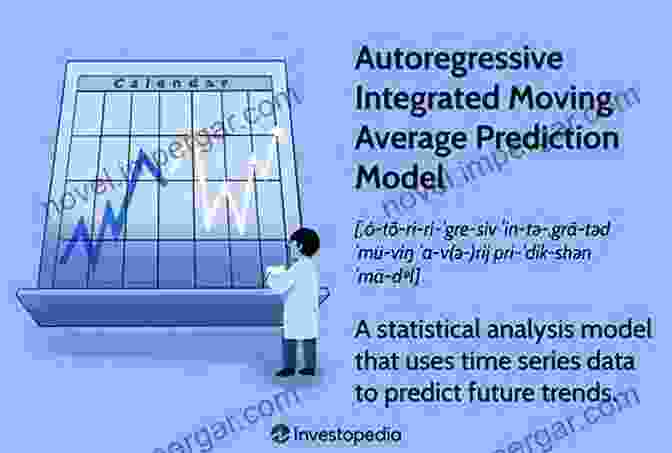

1. Autoregressive Integrated Moving Average (ARIMA)

ARIMA models leverage historical time series data to predict future values. They identify patterns and trends in the data, accounting for the autocorrelation within the series. ARIMA models are particularly effective when the time series exhibits stationarity, meaning it has a constant mean and variance over time.

ARIMA models leverage historical time series data to predict future values. They identify patterns and trends in the data, accounting for the autocorrelation within the series. ARIMA models are particularly effective when the time series exhibits stationarity, meaning it has a constant mean and variance over time.

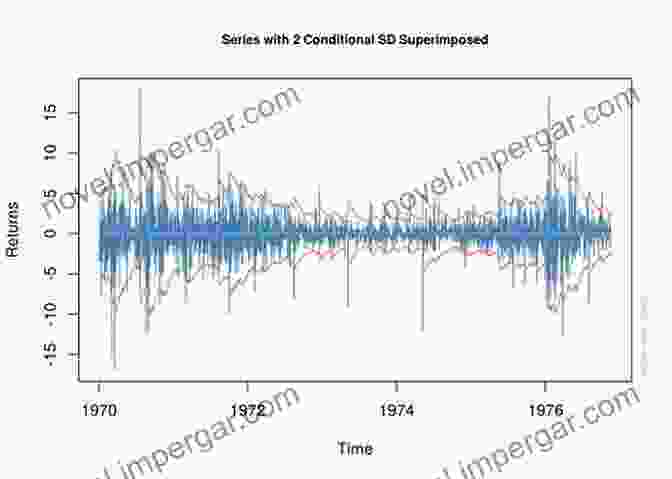

2. Generalized Autoregressive Conditional Heteroskedasticity (GARCH)

GARCH models extend the capabilities of ARIMA models by explicitly considering the volatility of the time series. They capture the clustering of volatility, known as heteroskedasticity, where periods of high volatility are followed by periods of low volatility and vice versa.

GARCH models extend the capabilities of ARIMA models by explicitly considering the volatility of the time series. They capture the clustering of volatility, known as heteroskedasticity, where periods of high volatility are followed by periods of low volatility and vice versa.

3. Support Vector Machines (SVMs)

SVMs are a type of machine learning algorithm that can be used for both regression and classification tasks. They construct a decision boundary that best separates the data points into different classes or predicts a continuous value, such as stock price.

SVMs are a type of machine learning algorithm that can be used for both regression and classification tasks. They construct a decision boundary that best separates the data points into different classes or predicts a continuous value, such as stock price.

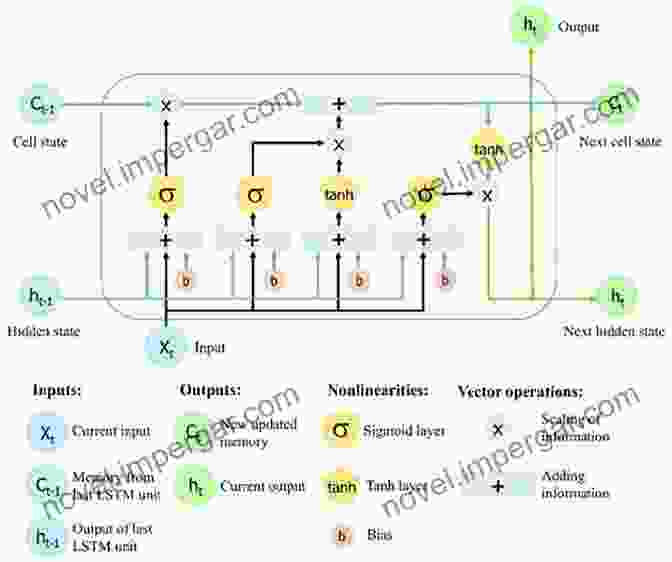

4. Long Short-Term Memory (LSTM) Networks

LSTM networks are a type of recurrent neural network (RNN) designed to handle sequential data with long-term dependencies. They possess the ability to learn complex relationships between input and output sequences, making them suitable for stock price forecasting.

LSTM networks are a type of recurrent neural network (RNN) designed to handle sequential data with long-term dependencies. They possess the ability to learn complex relationships between input and output sequences, making them suitable for stock price forecasting.

Evaluation and Selection of Price Forecasting Models

The selection of the most appropriate price forecasting model for SO stock depends on various factors, including the characteristics of the historical data, the availability of explanatory variables, and the desired forecasting horizon.

The selection of the most appropriate price forecasting model for SO stock depends on various factors, including the characteristics of the historical data, the availability of explanatory variables, and the desired forecasting horizon.

Model evaluation typically involves:

- Data splitting into training and testing sets

- Model training using the training set

- Model evaluation on the testing set using metrics such as Mean Squared Error (MSE),Root Mean Squared Error (RMSE),and Mean Absolute Error (MAE)

- Model selection based on the evaluation results and consideration of practical constraints

Practical Application of Price Forecasting Models

Price forecasting models for Southern Company's stock can provide valuable insights for investors, enabling them to make more informed decisions. The models can be used for:

- Identifying Trading Opportunities: By predicting future price movements, investors can identify potential trading opportunities, such as buying at undervalued prices or selling at overvalued prices.

- Portfolio Optimization: Price forecasting models can help investors optimize their portfolios by adjusting their exposure to SO stock based on predicted price changes.

- Risk Management: The models can assist investors in assessing the risk associated with investing in SO stock by providing forecasts of potential losses and gains.

- Investment Analysis: Price forecasting models can be used as a tool for investment analysis, supporting decisions on whether to buy, hold, or sell SO stock based on its predicted price performance.

Price forecasting models are indispensable tools for investors seeking to make informed decisions on Southern Company's stock. By understanding the factors influencing SO's stock price and leveraging robust forecasting models, investors can gain a competitive edge in the fast-paced financial markets. However, it's important to note that even the most sophisticated models cannot guarantee perfect accuracy, and they should be used as one of several factors in investment decision-making.

With this comprehensive guide to price forecasting models for Southern Company's stock, investors are well-equipped to navigate the complexities of stock market forecasting and enhance their investment strategies.

5 out of 5

| Language | : | English |

| File size | : | 1500 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Sachiyo Ishii

Sachiyo Ishii William Dietrich

William Dietrich Rosie Cappuccino

Rosie Cappuccino Wald Amberstone

Wald Amberstone Robert W Duffner

Robert W Duffner Roger Barth

Roger Barth Saundra Yancy Mcguire

Saundra Yancy Mcguire Sarah Pullen

Sarah Pullen Sharon Sliwinski

Sharon Sliwinski Toby Haberkorn

Toby Haberkorn Sean O Reilly

Sean O Reilly Robert M Pallitto

Robert M Pallitto Bouko De Groot

Bouko De Groot Tim Young

Tim Young Robert E Brown

Robert E Brown Ronaldo Collo Go

Ronaldo Collo Go William H Miller

William H Miller Richard L Muehlberg

Richard L Muehlberg Sam Zhang

Sam Zhang Richard Windrow

Richard Windrow

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Christian CarterNavigating the Future of Financial Regulation: Insights for Stability,...

Christian CarterNavigating the Future of Financial Regulation: Insights for Stability,...

Floyd RichardsonThe Campaign to Seize Norfolk and the Destruction of the CSS Virginia: A...

Floyd RichardsonThe Campaign to Seize Norfolk and the Destruction of the CSS Virginia: A...

Milton BellJourney Beyond Earth: Exploring the Final Frontier with "Lunar, Martian, and...

Milton BellJourney Beyond Earth: Exploring the Final Frontier with "Lunar, Martian, and... Spencer PowellFollow ·6.1k

Spencer PowellFollow ·6.1k Corbin PowellFollow ·13.3k

Corbin PowellFollow ·13.3k Vince HayesFollow ·17.8k

Vince HayesFollow ·17.8k Walter SimmonsFollow ·17.8k

Walter SimmonsFollow ·17.8k Miguel de CervantesFollow ·19.4k

Miguel de CervantesFollow ·19.4k Ken FollettFollow ·4.2k

Ken FollettFollow ·4.2k Johnny TurnerFollow ·14.8k

Johnny TurnerFollow ·14.8k Jan MitchellFollow ·5.8k

Jan MitchellFollow ·5.8k

Colt Simmons

Colt SimmonsLarge Collieries Iron Mines Stone Iron And Tinplate...

Step back in time and witness...

Zachary Cox

Zachary CoxUnlocking the Secrets of Woody Plants: An In-Depth...

: Embark on a captivating journey into the...

Yasunari Kawabata

Yasunari KawabataIntroducing 'Librarian Guide: 3rd Edition' – The Ultimate...

In the dynamic and ever-evolving...

Jerome Blair

Jerome BlairEvading Honesty: A Masterful Exploration of Deceit and...

Prepare to be captivated...

Timothy Ward

Timothy WardLove Is Real: A Novel of Love, Loss, and the Enduring...

Prepare to embark on a...

5 out of 5

| Language | : | English |

| File size | : | 1500 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |